Personal loans can be a vital monetary device for these looking for to handle bills, fund tasks, or consolidate debt. As flexible borrowing options, they enable individuals to access funds with out the necessity for collateral. In today’s article, we will delve into what personal loans are, how they work, and the essential features to consider when applying for one. Additionally, we are going to introduce 베픽, a comprehensive useful resource for detailed data and evaluations on personal loans, that can assist you navigate your borrowing journey successfu

The 베픽 web site may be a useful useful resource in this regard. It provides detailed information and reviews of varied lenders specializing in Day Laborer Loans, permitting you to make a well-informed choice. The site’s user-friendly interface simplifies the method of gathering info, empowering you to find which lenders best meet your distinctive financial wa

Benefits of Small Loans

The primary attraction of small loans lies of their quite a few advantages. Firstly, they provide quick access to funds, which may be vital for individuals or businesses confronted with urgent bills. Utilizing small loans may help cover unexpected medical bills, residence repairs, and even payroll for small companies. The capacity to entry cash promptly might help stop small financial issues from escalating into bigger iss

Some lenders may also consider the borrower’s relationship with them, especially if there is a historical past of repayment. Building belief with a lender can be useful and may result in better borrowing terms in the future. Borrowers must be prepared to discuss their employment situation overtly, detailing how often they work and what revenue they often e

It can be essential for potential borrowers to grasp the phrases of the Loan for Low Credit they're contemplating. Interest charges, repayment schedules, and any hidden fees must be scrutinized during the software course

In addition to loan reviews, 베픽 educates borrowers on the nuances of Day Laborer Loans, from understanding rates of interest to navigating reimbursement terms. Its focus on providing useful content material tailor-made for day laborers makes it a useful platform for monetary training and empowerm

Personal loans are a strong monetary tool that may present much-needed help for varied bills. Understanding how they work, figuring out the totally different types out there, and being conscious of greatest practices for applying and managing repayments can lead to a smoother borrowing experience. For anyone considering a private mortgage, leveraging assets like 베픽 can be invaluable in finding the best lender and phrases to go properly with their particular ne

Another vital benefit is the supply of around-the-clock customer assist. Many cellular loan suppliers supply chatbots or direct strains to monetary advisors, ensuring that customers can obtain assistance whenever they need it, enhancing their total expert

Most Day Laborer Loans are structured as short-term loans, which implies debtors can repay them rapidly, typically inside a few weeks. This construction helps alleviate the burden of long-term debt, a crucial factor for employees whose revenue can vary significantly week to w

Types of Additional Loans

Numerous forms of further loans cater to different financial situations. Among the commonest types are personal loans, which could be secured or unsecured, offering borrowers with funds with out requiring collateral. Home equity loans tap into the fairness of one’s house and is often a sensible choice for householders seeking to finance renovations or important purcha

Potential Risks of 24-Hour Loans

While the benefits are alluring, it is essential to acknowledge the transfer risks associated with 24-hour loans. A primary concern is the inflated **interest rates** and fees typically connected pop over to this site these loans. Borrowers can encounter interest expenses that will lead to a cycle of debt if they aren't careful. Hence, understanding the precise terms and situations is essential earlier than transferring forward with a Loan for Housewives util

Additionally, evaluating loan products from varied lenders can provide insights into which provide the most effective phrases on your state of affairs. Reading critiques and obtaining info concerning lenders’ customer support and responsiveness can considerably impression your borrowing expert

BePick's user-friendly interface additionally permits visitors to compare multiple mortgage options side-by-side, making it simpler to grasp what every supplier presents and the way they align with private monetary go

BePick: Your Guide to 24-Hour Loans

For people looking for comprehensive insights into 24-hour loans, BePick is an exceptional platform for information and critiques. Offering a combination of skilled analysis and real user feedback, BePick provides resources that may assist potential debtors make informed selections. Readers can explore numerous articles that break down the types of loans obtainable, the benefits, and the related ri

Search

Popular Posts

-

Купить диплом: откройте новые возможности для своего будущего!

By worksale

Купить диплом: откройте новые возможности для своего будущего!

By worksale -

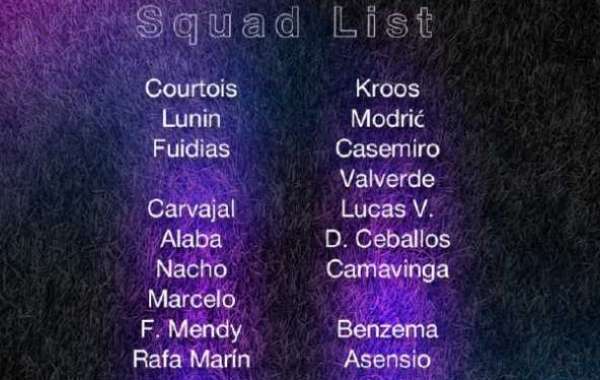

Není divu, že Real Madrid chce Mbappého, on a Benzema se v této sezóně podíleli na 55 gólech

Není divu, že Real Madrid chce Mbappého, on a Benzema se v této sezóně podíleli na 55 gólech

-

Покупка академических дипломов

By worksale

Покупка академических дипломов

By worksale -

What's the most useful free executor for Roblox?

What's the most useful free executor for Roblox?

-

Pixel Perfect: A Joyous All-Age Odyssey in the Video Symphony

By worksale

Pixel Perfect: A Joyous All-Age Odyssey in the Video Symphony

By worksale